OVERACTIVE MEDIA REPORTS FOURTH QUARTER AND FULL YEAR 2021 FINANCIAL RESULTS

April 19, 2022

Full Year 2021 Organic Revenue Growth of 69%

Solid Cash Position of $29.6 Million

April 19, 2022 (TORONTO, CANADA) – OverActive Media (“OverActive” or the “Company”) (TSXV: OAM) (OTCQB: OAMCF), a global sports, media and entertainment company for today’s generation of fans, reported financial results and operating highlights today for the three and twelve months ended December 31, 2021.

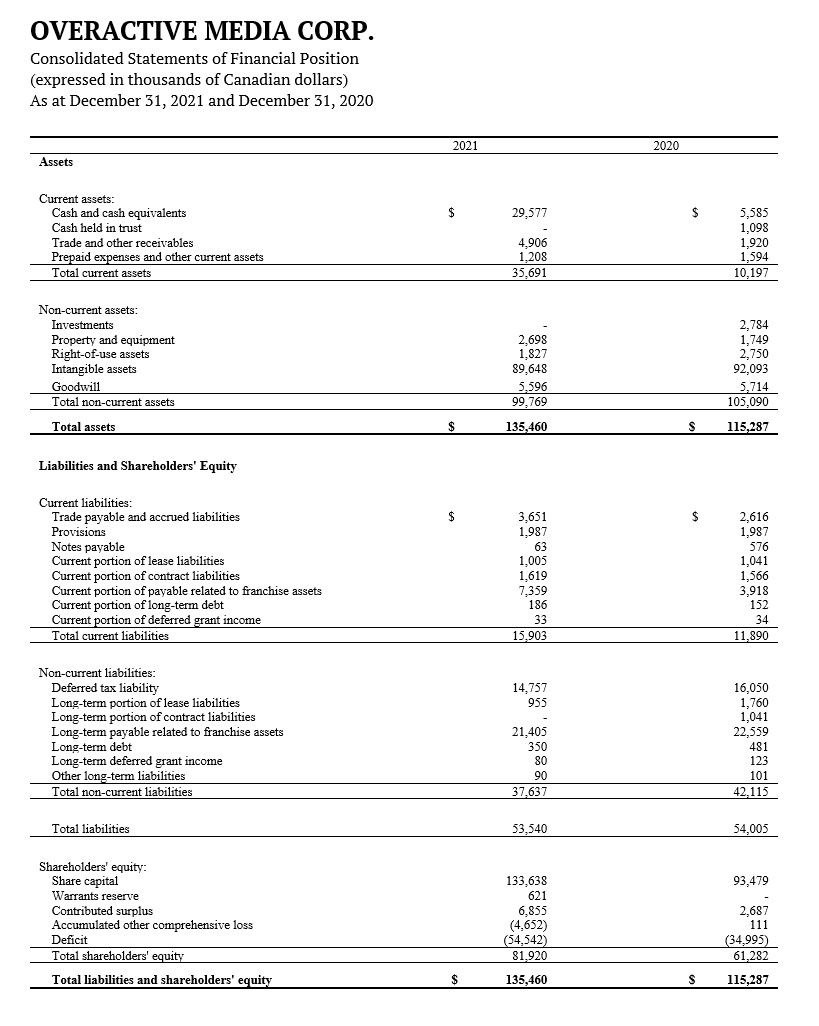

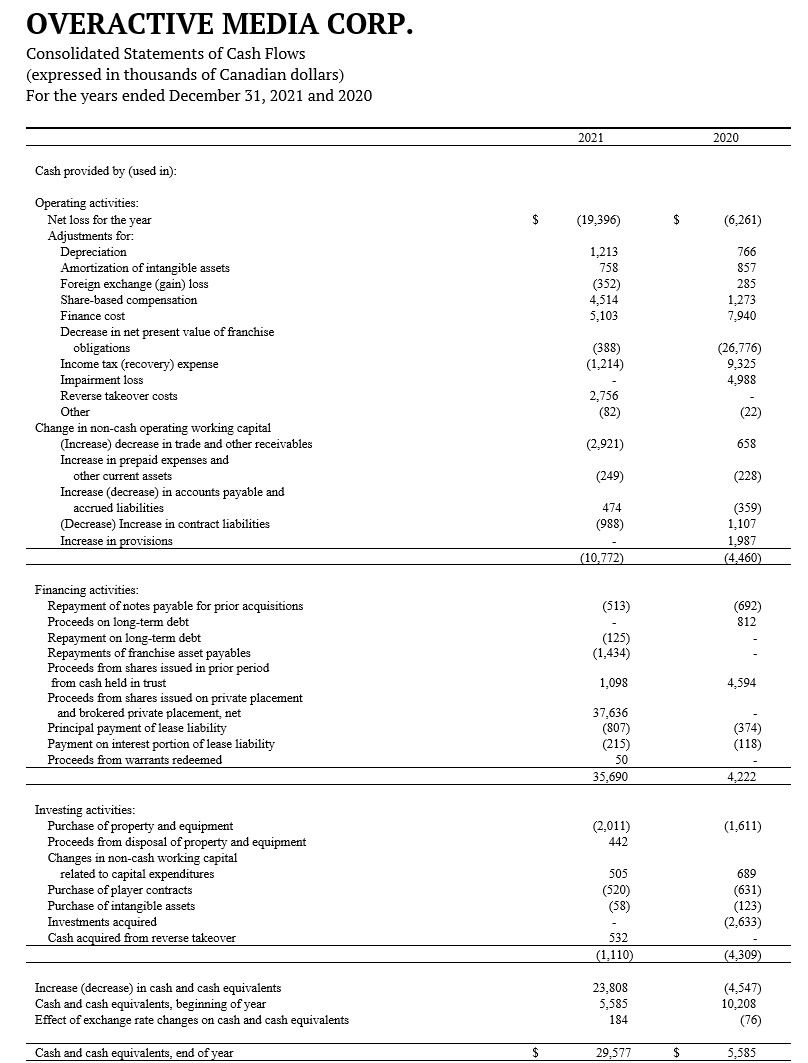

The Company’s consolidated audited financial statements, notes to financial statements, and Management's Discussion and Analysis for the three and twelve-month periods ended December 31, 2021, are available on the Company’s website at www.overactivemedia.com and under the Company’s profile on SEDAR at www.sedar.com. Unless otherwise specified, all amounts are in Canadian dollars ($).

Fourth Quarter 2021 Financial Highlights

- Fourth quarter 2021 total revenue increased by 340% on an absolute basis to $5.3 million. This includes a 132% year-over-year increase in business operations revenue, driven primarily by marketing partnership revenue.

- Fourth quarter 2021 total revenue increased by 49% when adjusted for differences related to the timing of certain league revenue share payments.

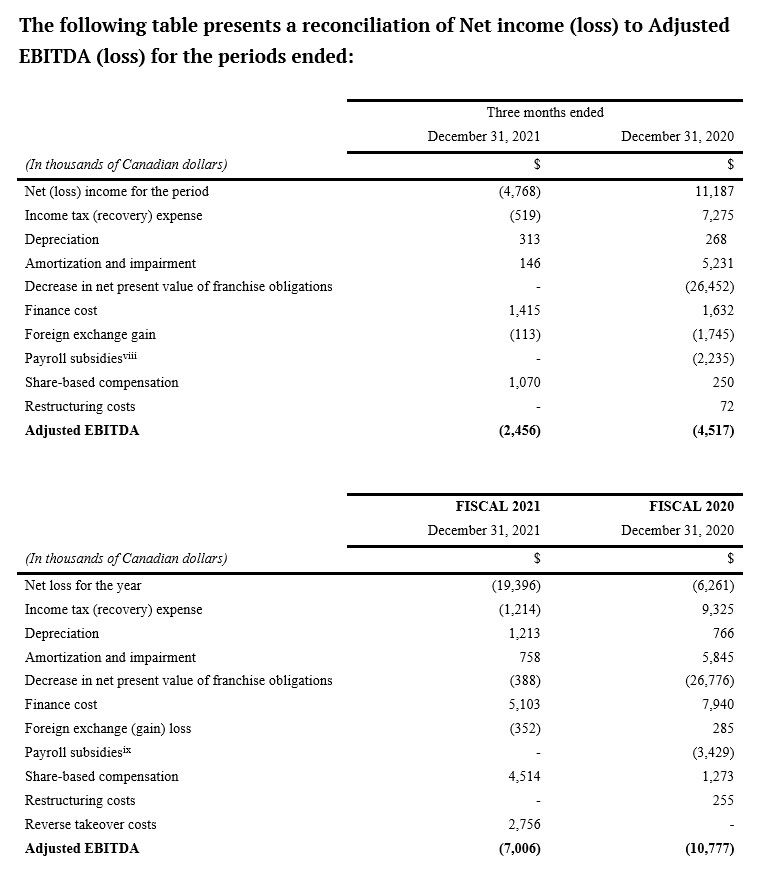

- Adjusted EBITDA[i] of approximately $(2.5) million, a 46% improvement compared to Adjusted EBITDA of $(4.5) million during the comparative prior-year period.

- Net loss of $(4.8) million, compared to $11.2 million during the comparative prior-year period. Net loss for the quarter included $2.3 million in non-cash costs, compared to $13.6 million in non-cash income in the comparative prior-year period. The comparative period benefitted from income recognized on modifications of certain payments related to our franchise obligations, partially offset by an increase in non-cash tax expenses.

- As of December 31, 2021, the Company had cash and cash equivalents of $29.6 million, compared to $5.6 million as of December 31, 2020.

Full Year 2021 Financial Highlights

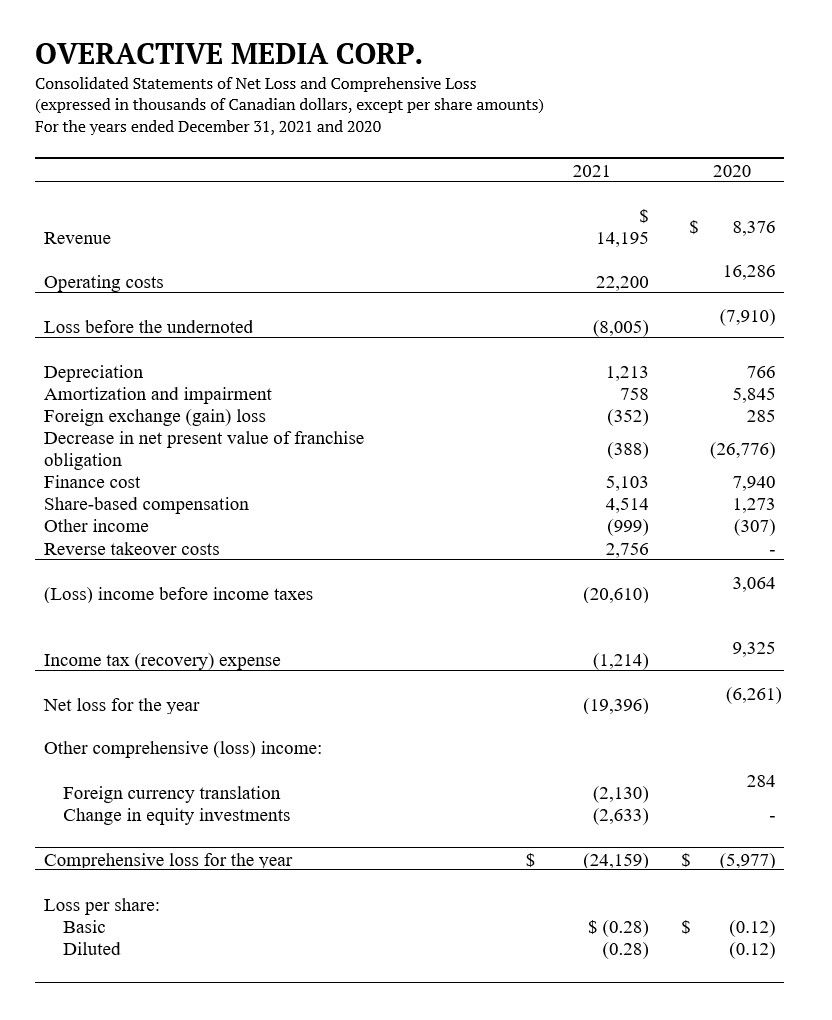

- Full year 2021 total revenue increased by 69% to $14.2 million, compared to $8.4 million for 2020. This includes a 109% year-over-year increase in business operations revenue, driven primarily by growth in partnership revenue.

- Adjusted EBITDA of $(7.0) million, a 35% improvement compared to Adjusted EBITDA of approximately $(10.8) million for the full year 2020. The higher revenues were the primary driver to the Adjusted EBITDA improvement.

- Net loss of $(19.4) million for the full year 2021, compared to $(6.3) million for the full year 2020. Net loss for the year included $11.2 million in non-cash costs, compared to $1.6 million in non-cash income in the prior year. The comparative period benefitted from income recognized on modifications of certain payments related to our franchise obligations, partially offset by an increase in non-cash tax expenses.

“We are very proud of the strong and scalable business that we are building,” said Chris Overholt, President and CEO, OverActive Media. “We are focused on generating high quality, long term and recurring revenue streams and we are succeeding. Furthermore, our business model offers a tremendous amount of operating leverage when delivered at scale. In fact, in 2021, of the $5.8 million increase to total revenue, $3.8 million or approximately 65%, contributed directly to an improvement in our Adjusted EBITDA.”

Overholt continued, “We set out on this journey in 2018 with three fundamental beliefs: partner directly with the publishers that own the game IP as it provides the greatest monetization opportunities; greater viewership would lead to growing revenue share payments from our league partners; and improving league economics, alongside the scarcity of these assets, would result in asset appreciation of our core franchises. Based on our 2021 accomplishments, our original business thesis is in fact, becoming a reality.”

2021 Summary

MAD Lions / League of Legends

- The first sale in the secondary market of an LEC franchise was concluded in 2021, at a reported price of €26.5 million ($39 million).[ii] This secondary sale reflects a 225% gain on OverActive’s purchase price of €8 million ($12 million), in December 2018.

- MAD Lions won historic back-to-back League of Legends European Championships.

- MAD Lions advanced to the semi-finals of the League of Legends Mid-Season Invitational, and the Quarter Finals of the League of Legends World Championship.

- MAD Lions reached peak concurrent viewership of 2,293,140 at the League of Legends World Championship, the highest among all western teams.[iii]

- MAD Lions aggregated over 56 million hours watched in 2021 (excluding China and India) ranking as the 2nd most-watched esport team in the west and 6th in the world.[iv]

Toronto Ultra / Call of Duty League

- In 2021, Toronto Ultra secured close to 500,000 new followers and a 454% year-over-year growth across its respective social channels. In just two seasons, Toronto Ultra has become the most followed team in the Call of Duty League on TikTok and the second most-followed team across all other social media channels.[v]

- Toronto Ultra was named ‘Property of the Year’ at the 2021 Sponsorship Marketing Awards, a first for an esport property. Toronto Ultra joined other notable winners including the Toronto Raptors, Toronto FC, the National Hockey League and the Canadian Olympic Committee.

- Toronto Ultra celebrated an incredibly successful season, winning Call of Duty Major II and appearing in the Call of Duty League Championship Grand Final, finishing 2nd.

- The Call of Duty League set viewership records in 2021 and 2022 and Call of Duty League Major I in 2022 was the most-watched Call of Duty Major in history.[vi]

Toronto Defiant / Overwatch League

- Toronto Defiant completed its best season to date in 2021, qualifying for the 2021 World Championship Play-in Tournament in North America.

- Overwatch League showed year-over-year gains in regular season viewership in 2021 and hosted the most-watched Overwatch League Grand Final in history.[vii]

- The Overwatch League is rebasing the game to Overwatch 2 for the 2022 season. Overwatch 2 is the highly anticipated sequel to Overwatch and will be launching an open beta on April 26, 2022.

OverActive Media

- Building on its existing roster of premium partners including Bell, Canon, imaginBank, Kappa, SCUF Gaming, Skip The Dishes, TD Bank and Universal Music Canada, OverActive added the following new marketing partners to its global roster: AOC, Bud Light, CRAVE Meals, El Corte Ingles, EPOS, GLS, GOIKO, Jack Link’s, MNP, Razer, Red Bull, SEAT, and Warner Music Spain. This drove a 109% year-over-year increase in business operations revenue.

- In February, OverActive announced intentions to build a 7,000 seat performance venue in Toronto. The performance venue reached a significant milestone in December, receiving approval from the Toronto City Council. See the press release here.

Significant Announcements Subsequent to Year End

- OverActive entered into a five-year partnership with Zilliqa on March 2, 2022, a leading provider of eco-friendly, high-performance, high-security blockchain solutions for enterprises and decentralized applications. This is the largest partnership to date for the MAD Lions brand.

- OverActive announced its entry into the VALORANT esports ecosystem on April 14. In connection with this transition, OverActive will be exiting the CS:GO esports ecosystem.

Conference Call

The Company will conduct a conference call tomorrow, Wednesday, April 20, 2022 at 9:00 a.m. (Eastern Time) to review the fourth quarter and full-year results as well as provide an overview of the Company's recent milestones and growth strategy.

To access the conference call, please dial 1-888-390-0605, or for international callers, 416-764-8609. A replay will be available shortly after the call and can be accessed by dialling 1-888-390-0541, or for international callers, 416-764-8677. The entry code for the replay is 218969 #. The replay will expire on Wednesday, April 27, 2022.

A live webcast of the conference call can be accessed on OverActive’s website at www.overactivemedia.com or directly via https://app.webinar.net/OaqMAYNZ1jE. An online archive of the webcast will be available via the same link for 90 days following the call.

[i] Adjusted EBITDA is a non-IFRS measure. Refer to “Non-IFRS Measures” at the end of this press release.

[iv] Top 10 Esports Teams in 2021 | Esports Charts (escharts.com)

[v] Data provided by Blinkfire Analytics

[vi] Call of Duty League sets new viewership record with CDL Stage 1 Major | The Loadout

[vii] Overwatch League Grand Finals Match Sets New Viewership Record (forbes.com)

[viii] Adjusted EBITDA excludes the impact of assistance payments received from Franchise Leagues and the CEWS program in 2020.

[ix] Adjusted EBITDA excludes the impact of assistance payments received from Franchise Leagues and the CEWS program in 2020.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements which constitute “forward-looking statements” and “forward-looking information” within the meaning of applicable securities laws (collectively, “forward-looking statements”), including statements regarding the plans, intentions, beliefs and current expectations of OverActive with respect to future business activities and operating performance. Forward-looking statements are often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions and includes information regarding the anticipated financial and operating results of OverActive in the future.

Investors are cautioned that forward-looking statements are not based on historical facts but instead OverActive management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although OverActive believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed thereon, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the OverActive. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements include the following: the potential impact of OverActive’s qualifying transaction on relationships, including with regulatory bodies, employees, suppliers, customers and competitors; changes in general economic, business and political conditions, including changes in the financial markets; changes in applicable laws and regulations both locally and in foreign jurisdictions; compliance with extensive government regulation; the risks and uncertainties associated with foreign markets; the ability of the Company to continue to execute on its existing partnerships and business strategy; the ability of the MAD Lions and Call of Duty Leagues to maintain viewership; the successful completion of the Company’s new venue; and other risk factors set out in OverActive’s filing statement dated July 2, 2021, a copy of which may be found under OverActive’s profile at www.sedar.com. These forward-looking statements may be affected by risks and uncertainties in the business of OverActive and general market conditions, including COVID-19.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although OverActive has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended and such changes could be material. OverActive does not intend and do not assume any obligation, to update the forward-looking statements except as otherwise required by applicable law.

Non-IFRS Measures

This press release includes references to adjusted EBITDA. Adjusted EBITDA is a non-IFRS financial measure and is defined by the Company as net income or loss before income taxes, finance costs, depreciation and amortization, decrease/increase in net present value of franchise obligations, foreign exchange gains/loss, assistance payments from Franchise League and government assistance, restructuring costs, reverse takeover costs, intangibles assets impairment charge and share-based compensation. We believe that adjusted EBITDA is a useful measure of financial performance because it provides an indication of the Company’s ability to capitalize on growth opportunities in a cost-effective manner, finance its ongoing operations and service its financial obligations.

This non-IFRS financial measure is not an earnings or cash flow measure recognized by IFRS and does not have a standardized meaning prescribed by IFRS. Our method of calculating such a financial measure may differ from the methods used by other issuers and, accordingly, our definition of this non-IFRS financial measure may not be comparable to similar measures presented by other issuers. Investors are cautioned that non-IFRS financial measures should not be construed as an alternative to net income determined in accordance with IFRS as indicators of our performance or to cash flows from operating activities as measures of liquidity and cash flows.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.